When Detective Constable Rebecca Mason first visited the Hertfordshire flat of Alan Baldwin in November 2020, months after lockdowns had begun and each of our worlds had shrunk, it was to break the news that the person he was in love with did not exist.

Police officers are often the last to know when someone is being conned. A worried son might spot unusual payments on his elderly father’s bank statement. A concerned friend will do a reverse-image search on a suspiciously good-looking dating-app match. A fraudster will run out of excuses as to why they can’t meet. A horrible realisation will dawn and a report will be filed.

But Mason was developing something of a specialism: she had begun tracking down victims before they even knew they were victims, locating fraudsters before anyone had reported a fraud. As she and a colleague sat at Baldwin’s dining room table, which was covered with assorted paperwork, they explained what had brought them to him.

[See also: The year woke broke: a brief history of a contested word]

The first lead had come three years earlier, when Mason was investigating her first case of “romance fraud”, an increasingly common form of online deception in which a relationship is fostered and then money extracted. The daughter of 63-year-old Sharon Turner had contacted the police after noticing Western Union transfer receipts for large amounts in her mother’s London home. At first Turner had denied all knowledge; then she had borrowed more from family and friends in order to keep making transfers.

Finally, Turner revealed that she had been sending money to Kevin Churchill, a well-spoken businessman she had met on the mature singles site Wise Owl Dating. Over eight months, Churchill had sent her flowers and professed his love, while requesting ever greater sums, for everything from vet bills to business expenses. They had never met, though they had often spoken on the phone.

The sums were huge – Turner had sent £240,000 in all, though this in itself was not unusual. As Mason looked further into the case, following the money through numerous accounts, she found they led not just to one person, but to a multinational network in which everyone profited from the same fake persona: “Kevin Churchill”. Mason tracked over 40 victims; the money totalled millions.

After that, the plot thickened: one multinational network would link to another, and another still, each with its own fake persona and modus operandi (many remain under investigation, and cannot be reported). Within months, Mason realised she was looking at the manufacture of infatuation on an industrial scale. The networks even had WhatsApp group chats, where fraudsters sought each other’s advice, like teenage girls perfecting a reply to a boy.

Even within this river of illicit money, one bank account stood out: funds from several of the networks seemed to flow through it, a tributary before it split. The account holder: Alan George Baldwin.

To the untrained eye, Baldwin’s account appeared to belong to a criminal. But Mason knew that the accounts of long-term fraud victims can resemble the accounts of the fraudsters themselves. Often, they are the first entry point for funds elicited from other victims before being siphoned elsewhere. Mason’s theory was that Baldwin was being used as the networks’ currency exchange.

One payment in particular concerned her: a £1,500 transfer that went out every month, like a mortgage payment, just after Baldwin’s pension had cleared. It didn’t fit any of the payments coming in. This, she realised, was Baldwin’s own money.

On that first visit, Baldwin calmly told the officers that the payments had been sent to a friend, Fred Williams. They had matched on the dating site Gaydar, and Williams’s requests for money had started out small – £20 or £30 for a few drinks – before escalating. He was a Nigerian national, Baldwin explained, who lived in America. The sole heir to his father’s estate, which included several UK properties, Williams needed financial assistance in order to claim his inheritance. Baldwin had been assured he’d be repaid once it came through.

When Mason explained that he appeared to be a victim of fraud, Baldwin was adamant: no. He spoke, Mason recalls, as if Williams lived with him, and would be back any second to clear this up. Baldwin, who is 66, short and slightly overweight but neatly dressed, told the police that he and Williams were making holiday plans. He admitted they had never met, but how could they? Williams was so busy. The officers noted that the glass cabinets in the living room were filled with mementos from trips Baldwin could no longer afford.

It was only later, on a second visit, that Mason realised how deeply, in every sense, Baldwin was invested. So much money had passed through his bank accounts that they were constantly being closed due to suspicious activity, meaning Mason had only been able to review the past two years’ worth of statements. (Baldwin had been assured by Williams that these irregularities were merely misunderstandings.) In an almost offhand remark, Baldwin revealed to Mason that he had been making these payments since 2005 – 15 years earlier.

If the first digital age was a story of ground relentlessly gained – reshaping everything from our politics to privacy, dating to doorbells, laying entire industries to waste – then its second will surely be one of consolidation and control. A realisation, perhaps, that the more we treat the internet like gravity, the less we know which way is up.

Crime has not just proliferated online but mutated. The mugger, the burglar, the kidnapper: these professions, too, have been ripe for disruption. Not eradicated, of course, but there have been lay-offs. You are now ten times more likely to be a victim of fraud than of theft. According to Action Fraud, the UK reporting centre for cybercrime, fraud accounts for around 41 per cent of all crime.

Romance fraud is the fastest-growing category, increasing by almost a third last year (to £93m) according to UK Finance, which collates data on behalf of high street banks. Two in five online daters have been asked for money, and over half of those gave it. The average loss is estimated to be around £11,500, more than double what it was the previous year. Meanwhile, just 1 per cent of police resources is devoted to tackling economic crime. Only one in every thousand cases, it is estimated, is solved.

When the Online Safety Bill began its passage through parliament earlier this year, romance fraud was within its scope. In March, the then security minister Damian Hinds told the Commons that: “Organised crime groups have discovered new ways to take full advantage of people, using increasingly sophisticated methods which would trick even the most scrupulous of individuals.”

But the legislation that eventually received royal assent in October focused largely on child safety and pornography, with little addressing the safety of vulnerable adults. There was one nod: dating apps are now required to ensure that user profiles are genuine, though it remains unclear how.

For Elisabeth Carter, a criminologist and forensic linguist at Kingston University, the bill was a missed opportunity. “There’s a massive gap, and it’s a disappointment that it wasn’t specifically covered,” she told me. Carter said victims of romance fraud – who often stay in touch with their fraudsters long after the police have informed them of their crime – have much in common with victims of domestic violence and coercive control. In her view, it should be folded into the 2015 Serious Crime Act, which tackles those offences, and treated not just as an economic crime.

When I asked Mason what new measures a dating app could take, she told me that apps such as Tinder already have a “verified” option, which confirms users’ profile photographs via an in-app selfie. But, she added, she had done this on her own account, only to then swap her profile pictures for someone else’s, and still remained verified. In fairness, she said, she had tinkered with the app so much – testing for vulnerabilities, in the name of work – that Tinder had recently given her a lifetime ban.

Rebecca Mason is 35, a caffeinated talker and a detective with a curious specialism. Her route to becoming the UK’s leading romance fraud specialist was part coincidence, part calling. After leaving school, she worked in the fraud department of the Royal Bank of Scotland, only to find the bank itself the victim of financial maleficence. In 2008, the then chairman Fred Goodwin resigned in disgrace after RBS lost £24bn in a single year, the largest loss suffered by any business in British corporate history. Mason remembers the devastation it caused at branch level, and was one of many who jumped before they were pushed.

She joined the police force – she had always loved The Bill – and landed in CID, before moving to the Economic Crime Unit. That she took to the work so naturally was as much a surprise to her as anyone else: she had needed a maths tutor as a child. But she came from a family of accountants who were happy to explain anything she didn’t understand over Sunday lunch.

Most days, Mason works alone, sometimes putting in 20-plus hour investigative shifts for Woking’s Economic Crime Unit; a workload that is more commonly tackled by an entire unit within the City of London’s vast economic crime directorate. When she isn’t investigating fraudsters, she appears as an officer on Channel 4’s Hunted, a gameshow in which fugitives must evade the law. Once, she tracked down the Olympic gymnast Louis Smith to a hot tub.

Say “romance fraud”, Mason tells me, and most people think of a lonely divorcee whose holiday fling moves in with her, or a moustached gentleman offering a once-in-a-lifetime investment opportunity. Someone like the “Tinder Swindler”, the Israeli conman Simon Leviev, who claimed he needed money for security guards to protect him from his enemies, and who became the subject of a 2022 Netflix documentary of the same name.

Even when the fraudsters operate in person, they are not easy to catch. If your modus operandi is getting engaged to older women then persuading them to sell their houses (as the serial British fraudster Richard Robinson did), you might expect that a knock on the door would never be far away. Indeed, in 2020 67-year-old Robinson was sentenced to ten years, after being arrested while working on what seemed to be his second victim. But it turned out he had at least 30 other aliases and a conning career that dated back to 2013.

While it is the cases involving millions that generate headlines, the reality is that most scams involve smaller sums and long shifts that can look like actual work. Earlier this year a Sussex man, Andrew Camfield, was convicted of conning £70,000 from his partner over a four-year period, having falsely claimed he was due a large inheritance. Taking into account the time he’d spent on it, the sum worked out at slightly less than the minimum wage.

The era of internet dating has both streamlined this process – fraudsters can work from home – and allowed criminals to impersonate other, more eligible people, depending on whose pictures they steal. (Back in 2007, in internet dating’s infancy, so many fraudsters were using photographs of a racing driver called Robert Frost that he started being recognised by women in airports. “Wait… isn’t that?”) Artificial intelligence is about to enable another quantum leap: from little more than a download, criminals can now digitally look and sound like almost anyone they want to.

What Mason was discovering now was that ultra-organised criminal networks were taking over. “There are people in the UK,” she told me. “People in America. People in China. People in Ghana. And they will message each other on a group chat and say, ‘Right, I need someone with a UK bank account.’ And someone will have a bank account in the UK that they can launder their money through.”

Most romance frauds owe their origins to “The Spanish Prisoner” scam, which dates back to the 16th century. Wealthy gentlemen were told of a Spanish nobleman who was being held captive; if they could help bribe the guards to release him, they would have a share in the reward his family was offering. The nobleman, it was mentioned, had a beautiful unwed daughter. Was sir married? Every email you have ever received from a Nigerian prince – requesting a small fee in order to release a large fortune – is the Spanish Prisoner trick without the bride.

But a romance scam offers an emotional reward rather than a financial return. Victims will be asked to help with an emergency – anything from overdue school fees, as British construction worker Jamie Parker did in 2018, defrauding a woman out of £20,000; to payment for employee funerals, as Nigerian Osagie Aigbonohan did in 2020, extracting the same amount from multiple victims. The incentive is always the same: only then can the lovers be together. Money for plane or train tickets is a common request. (Sometimes, as was the case with Liverpudlian Ivan Nkazi, they settle for petrol.) It is this that makes romance fraud so insidious. It trades in love, not greed.

Mason is sometimes so enraged by fraudsters that she tackles them in her spare time. If she ever receives a scam phone call, she feigns interest to keep them on the phone: “I figure if they’re speaking to me, they’re not speaking to someone else.” And if Nigerian scammers email her, she always asks for a loan, just to see what they’ll say.

Yet even she is not immune from fraud. Just recently someone set up a fake Tinder profile using Mason’s photographs. She got it shut down immediately, but worries that the damage was done: “It wouldn’t surprise me if, in three years’ time, a report comes through of me conning people out of a ton of money.”

Sharon Turner’s case had landed on Mason’s desk in September 2016, on her second day in Surrey Police’s Economic Crime Unit. Codenamed Operation Bench, it was opened by CID six months earlier, but little progress had been made. “That’s not a criticism. I wouldn’t expect an officer at CID, who’s potentially got a kidnap and high-risk domestic, to make it their top priority.” And on its own, Turner’s case appeared relatively innocuous. “It’s a vicious cycle,” Mason explains. “Police officers think: ‘How can someone send them money?’ It’s not someone breaking into your house. And it goes to the bottom of the pile. Victims don’t report it, because they think they’re not going to be taken seriously.”

To start with, the case mostly matched what Mason already knew about romance fraud. Kevin Churchill – the person Turner thought she was in a relationship with – was a travelling businessman. Fraudsters mostly stuck to professions where requests to send money internationally didn’t raise a red flag. Army officer was popular, as was oil rig worker. The frequency and size of the sums would increase over time, until it became almost a habit. Even after Mason told Turner she was likely to be a victim of fraud, she kept sending money: another £50,000 in all. Psychologists working with the police call this “betrayal blindness”, something also common among victims of domestic violence. Of the 40 or more other victims – doctors and dentists among them, aged between 40 and 70, some of whom knew Churchill as Kevin Thompson – only one other would speak to Mason.

By December 2016 Mason had identified nine suspects. Looking through the WhatsApp chat logs that Turner had provided, she realised the fraudsters weren’t just sharing the profits, but the workload, too. Churchill would often forget something Turner had told him the day before, such as that she was visiting her daughter. It had, clearly, been someone else’s shift.

In July 2019, seven of the fraudsters behind Kevin Churchill were convicted at Guildford Crown Court. Their properties – in Hampshire, Stoke, Birmingham – had been raided, while two suspects fled abroad. Mason never discovered how they met, but she had successfully traced the money that linked them; it was the first time a criminal gang had been convicted of romance fraud in the UK. The group’s ringleader, Nicholas Adade, had set up five time zones on his phone to help him pose as the jet-setting Churchill. Turner, meanwhile, lost her home and moved into shared accommodation. She contemplated suicide, and now relies financially on her daughter.

Soon after, the Turner case led Mason to Alan Baldwin’s door. Baldwin, in turn, would spawn two new investigations. One is expected to go to trial next year. The other involved the man Baldwin knew as Fred Williams – a case that would give Mason the most complete picture yet of how sophisticated the networks had become. The text messages between “Fred Williams” and his victims numbered in the millions.

When Mason first approached the City of London police for an analyst who could help her with this mass of digital information, she was dismissed. The problem with organised romance fraud, she was told, was that you could never fill in the blanks: the investigators had no idea what the suspects were saying to each other.

“Well, I do,” Mason replied. She was by now in possession of a trove of laptops, USB sticks and smartphones. She remembers a long silence. They offered her an analyst on the spot.

[See also: Welcome to the age of “deepfake” porn: Your starring role in a sex film is just a few selfies away]

When Mason visited Alan Baldwin in January 2021, she left with a sinking feeling. He was still insisting Fred Williams was real; after 15 years, they were in love. She had asked Baldwin not to tip off Williams, and suspected he wouldn’t – if only for the fear of never hearing from him again.

The payments Baldwin had been sending were made not directly to Williams, who said he didn’t have a UK bank account, but to a man called Frederick Diji, whom Williams described as the relative of a friend. It was a name that another British man, Paul Greenway, had reported the previous summer after connecting with a young Swedish man on match.com. The pair had exchanged romantic messages and talked about living together. Then the requests for money began. His name was Alan Baldwin, presumably to avoid suspicion when Greenway sent money to Baldwin’s account. But he had also been directed to send money via PayPal to a friend of Alan’s: Frederick Diji.

Mason applied to a judge for a production order on Diji’s bank account, which was granted. These are not unlike a statement: depending on the bank, they arrived in Mason’s inbox as a password-protected pdf or Excel spreadsheet. It transpired that Diji was a 37-year-old Nigerian national who had outstayed his visa, and his account was about to give her a snapshot of the wider network.

Fraudsters will often move money between several accounts, a process called “layering”. Each new click puts them a month ahead of any investigation, as a detective waits the required 30 days for a bank to release statements. They didn’t need to outsmart the police, they just needed to outlast their resources. But Mason prides herself on her staying power. She went on to find 18 separate accounts in Diji’s name, but needed only the first for a warrant to arrest him. Diji, she told me, was “a one-man crime spree all unto himself”.

When officers raided his south London flat at dawn on 29 April 2021 they found an evidential goldmine. Within minutes, the officer in charge of retrieving electronic equipment contacted Mason at Woking headquarters. She had been there until 2am the previous night and hadn’t slept. Now the raid had uncovered more than she could have hoped for. Laptops, smartphones, memory sticks. Jackpot.

Mason always worries that romance fraudsters will wipe their phones; it is the obvious thing to do. But often they can’t, “… because they’re going to forget what they said [to victims], because it’s not true. And they’ll be speaking to ten people a day.” A Blackberry seized in the raid contained WhatsApp conversations between Diji, always posing as a young gay man, and more than 70 victims. Like Baldwin, they were all older men – a generation who had grown up stigmatised by their sexuality and were less likely to speak out. Some were married. Unlike Baldwin, they had all been contacted in lockdown, a historic moment that had delivered both the perfect excuse not to meet and an endless supply of lonely souls. Now Mason would have to break the news to them all.

Some said they already knew in their hearts. Some had already broken off contact. Many had reported their suspicions to local police, only to be told there was little they could do. They had given their money willingly, after all. A few continued to send money. When Mason took Diji’s phone to Alan Baldwin to show him the messages he had been sent, he thanked her politely, and resumed his correspondence with Fred Williams via email. Diji was then in custody; the person who responded was most likely Solomon Diji, his brother.

As Mason pored over the data, reading thousands of pages of chat logs and bank statements, it became clear that as well as his links to the wider network, Diji had several scams of his own on the go. There were documents related to a “General Austin Scott Miller”, a classic Spanish Prisoner email scam in which Diji offered people a cut to help him move millions out of Iraq. There were photographs of a blonde woman in a folder labelled “Gemma” and messages to men posing as her. There were jpegs of fake passports.

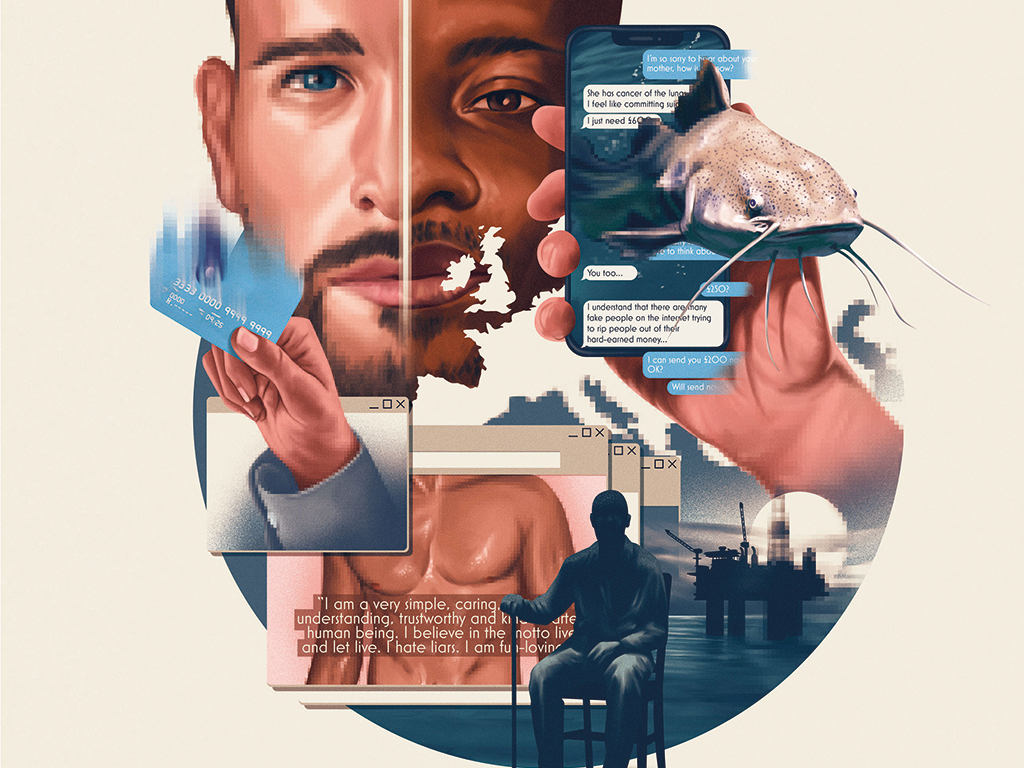

But the documents related mostly to one identity: a Swedish man in his mid-twenties, sometimes called Alan Baldwin and sometimes called Luke James, who worked in a nursing home. There were photographs of funerals, death certificates, boarding passes, inheritance documents. A Notes document recorded a dating app profile: “I am a very simple, caring, talented, understanding, trustworthy and kind-hearted human being. I believe in the motto live and let live. I hate liars. I am fun-loving…” Written beneath it was a list of 14 dating sites: Gaydar.co.uk, Manhunt.com, Daddyhunt.com, Silverdaddies.com…

Looking through the chat logs, Mason saw that Diji would message his girlfriend, British parole officer Raquel Johnson, or a contact saved as Jamal, who was based in Nigeria, to ask for help in drafting replies. Diji was so prolific with his texts to older men that, at one point, Johnson asked his brother if Diji was secretly gay.

One voice-note Diji sent Jamal seemed to detail the wider strategy: “You send love messages first, the money they give you. Later say your mother has gone to hospital, that she has collapsed. You’ll get back to them with what the doctors are talking about. Say it’s cancer of the lungs. Then you say your mum has died. Ask for some money for the burial, then you say you have inheritance…”

Mason checked, as she always did, the last thing Diji had googled before his arrest. It was: “Loving message ideas”.

Kevin Poole likes to point out that he was good-looking as a younger man. This isn’t a boast, more an explanation. Even at 77, his thick silver hair breaks left to right over a prominent brow. Had he been less attractive, his eternal bachelorhood might have gone unnoticed. The children at the schools where he taught, from 1968 until he took early retirement in 2000, might not have turned homophobic taunting into a life sentence, each school year handing the baton to the next.

There had been one relationship, in the Eighties, with a man he met in a Nottingham nightclub. When the man moved in with him, Poole told his colleagues that he was his new lodger. But the relationship turned violent, something his family learned only when he asked his younger brother for help. His mother asked him to promise he wouldn’t live with a man – “I don’t agree with it” – and they never spoke of it again.

When the first lockdown came, Poole was prepared for loneliness but hadn’t reckoned on the vastness of it. He had worked two days a week as a welfare officer in his retirement, but was soon furloughed and even work Zooms evaporated.

A lung condition, pulmonary fibrosis, meant he had to shield. The days lost shape, as he baked and watched his beloved Manchester United on TV. The only human contact came in the form of a friend who brought him his shopping, a ration of ten minutes a week. Poole was on dating apps but just for conversation, each notification an adrenaline high. “You were just grateful for communication in some way, shape or form,” he told me when we spoke this autumn.

When he matched with a young Swedish man named Luke James on Badoo, in July 2020, the conversation seemed different. James seemed kind; he worked in a care home – “just the type of person I’d like to have met”. Poole couldn’t tell me exactly what his profile said, “but there was room for photographs”. Meaning: it didn’t hurt that James was beautiful.

The two men soon moved from Badoo to WhatsApp. Within an hour of James’s first message (“Hello Kevin”), he’d sent Poole a shirtless selfie, and said he wished he was there with him. “I wish so, too,” Poole replied. “You are the kind of man I have been searching for all my life,” James said.

A few weeks passed like this: texts full of intense longing, punctuated by conversations about the films they liked, the countries they would visit once they could. They spoke often of meeting – how incredible it would be! – but Poole’s condition and James’s job meant they had to be cautious. They talked on the phone, sometimes for an hour at a time. “Life became a lot happier – it became worth living,” Poole told me. He spent days looking forward to a call, even if it lasted just a few minutes.

[See also: The Future Will Be Synthesised: a glimpse into a deepfake dystopia]

In August 2020, James texted to say his mother was ill, and he was travelling to Sweden. Later he sent the diagnosis: “cancer of the lungs”. She died five days later. “I feel like committing suicide,” James wrote, and asked for £600 to help with funeral expenses. When Poole questioned this (“I’ll need to think about this… I’ve lost money in the past,” he texted), James tried to reassure him: “I understand that there are many fake people on the internet trying to rip people out of their hard-earned money.” Poole agreed to send £200, and James gave him the bank details of a man he claimed was his flatmate: Alan Baldwin.

More requests followed. Poole was sceptical, but with each payment he made – £200 here, £150 there – he found himself more committed. A curious thing happened: he became less sceptical, not more. At one point he offered money, unprompted. Sometimes he cried himself to sleep, but still pushed the doubts away. Each transfer came with a promise of return. “I was just there, dangling, looking for a relationship,” Poole said.

In part, he supposes, he didn’t suspect fraud because the numbers were relatively small. They texted constantly. Who would go to such lengths? By the time James asked for £200 for a flight home in October, it felt as if the money had been worth it. The two men made plans to spend Christmas together.

It was only then, months after they first matched, that James asked for a large sum: £5,000 to cover the legal fees for his £25,000 inheritance to be released. He sent documents that appeared to back this up. “I don’t want to lose you,” texted Poole, pointing out that the paperwork contained spelling errors. He sent the death certificate James had sent him to the Swedish embassy in an attempt to verify it, but received no reply.

Poole said it worried him that they had only ever made voice calls, never video. “I need to know that the person I am ‘speaking’ to is the person whose photo it is,” he wrote. James’s messages became more florid, writing: “When you fully trust someone without any doubt either you get a person for life or a lesson for life,” a sentiment that had almost certainly been copied and pasted from elsewhere.

Looking back, Poole can only explain what happened next as misplaced kindness. Towards the end of November, James called him in distress. Poole listened as he sat at his computer, his online banking page open. There was a bottle of champagne in the fridge, ready for James’s arrival. He had bought new towels, fluffy white ones, and made space in his wardrobe. James said he could fly back next week, if only he had the money. As James began to weep, Poole clicked send. First £3,500; then, a few days later, another £1,000.

By the time he went to collect James from Birmingham airport on 4 December 2020, all doubts had left Poole’s mind. Sure, there was that time he had sent flowers to a Swedish address that did not exist; but it could easily have been a mistake.

James began calling while Poole was driving; he only saw his WhatsApps after he’d parked. Complications arising from the inheritance, James said, meant he had been detained by customs in Amsterdam, where he was catching a connecting flight; now he was being sent back to Sweden. A distressed Poole called a friend. Suspicious, they did a reverse-image search on photographs of James: they were from the Instagram account of an Austrian model called Florian Maček. That evening, Poole sent a one-word text – “florianmacek” – to the man he knew as Luke James, followed by links to several photographs of Maček that James had sent him.

In London, Frederick Diji texted his brother, Solomon, within minutes: “Omo, that client don go search my id on Instagram sha.” “Oh boy,” Solomon replied. “All these clients wey Dey search.”

Solomon’s emergency response was not sophisticated. “Swear down,” he said. Say that, “dey use ur name for insta” and “say you go report”. In other words: that Florian Maček’s account was fake, and the pictures stolen from James. To Poole, James texted: “Somebody has been using my pictures,” and “Please ignore it, nobody should come between both of us.” This was why he didn’t use Instagram, he said: “It’s filled with fake people.”

Poole told me he knew then that Luke James wasn’t real. But love is a tricky thing: it remains, even when nothing else does – not even trust. That may be one reason why he never tried to contact Maček. A few days later, Poole asked James to marry him. “That would be wonderful my love,” James replied, neither a yes nor a no. James asked for another £20,000, which Poole didn’t send. But they talked for another four months, exchanging almost 13,000 texts between December 2020 and April 2021, along with regular phone calls. Poole sent a few hundred pounds here and there, another £3,000 in all, hoping against hope that they might soon meet.

Even after Diji’s arrest in April, “Luke James” remained in contact, sending Poole an email while Diji was on bail. “I was robbed and my phone was stolen,” he wrote, “I just got out of the hospital, please send your number, I miss you so much.”

Under instruction from Rebecca Mason, Poole replied to say that he missed him, too. That summer, via Alan Baldwin, he transferred James another £600.

The trial of Frederick Diji and Raquel Johnson on charges of conspiracy to defraud and money-laundering was due to last two weeks at Guildford Crown Court. In the end, it barely lasted a day. The defence presented on 7 December 2022 was so thin Mason could hardly believe it had gone to trial. Diji and Johnson did not dispute the evidence, but claimed the devices found at their property had nothing to do with them.

It was a risky strategy, but it sometimes worked. Fraudsters themselves often claim fraud, that someone else has opened an account in their name. Usually, Mason has to hunt for slip-ups – a phone payment that links to a particular address, a damning Deliveroo. Here, the evidence was overwhelming. As the Crown prosecution barrister Charlotte Hole noted in her opening statement, even the BlackBerry Diji claimed wasn’t his contained several identifying selfies.

Only five of their 80 victims formed part of the case. It was a necessary winnowing down: more victims would have meant less evidence for each, and a less compelling case. But it was proving easier than Mason and Hole had expected. When I arrived for the trial’s second day, I met Mason vaping on the steps outside. “We might have a plea!” she said.

Diji’s pre-trial statement had claimed that he was gay, and so needed asylum from Nigeria where homosexuality is effectively illegal; he said friends had taken over his bank accounts. This was undermined by Hole’s opening statement, which noted phone messages between Diji and an adviser in Nigeria, a member of the larger network, concocting this exact cover story two years earlier. The adviser had suggested Diji create a profile under his own name on gay dating sites as evidence, and proposed including a picture of his penis. (Messages found on his devices revealed that Diji had sent a sample which didn’t pass muster: “People are more likely to click and chat you up if they see a full hard and erected dick than a flaccid dick,” the adviser chided.)

The defence did not appear to have reviewed much of this evidence; it was only when they heard Hole’s opening statement that they seemed to realise it was overwhelming. In the corridor, I overheard Diji’s barrister tell Johnson’s that he’d just got so angry with his client that he’d accidentally broken his MacBook. Back in the courtroom, Diji and Johnson pleaded guilty.

At the sentencing a couple of weeks later, Judge Robert Fraser praised Mason’s work. He told the court that when he had first seen the evidence bundles – some 1,500 exhibits, a fraction of the whole – he found it hard to believe it had been put together by a single detective: “Quite remarkable because of the length of the investigation. It is very clear she worked tirelessly,” he said.

The victim impact statements were read out, and perhaps the most striking was Alan Baldwin’s. He referred to Fred – whom he had talked to twice a week via GChat and known for 15 years – as a friend, still. He had sent him more than £100,000 in total, he wrote. When Fred had asked him to increase his monthly payment to £2,000, he had had to explain that he could barely survive as it was. “I would consider Fred as a good friend after all the time we have been in contact and I care about him,” Baldwin wrote. “He has promised to pay all the money to me once he receives his inheritance. Fred is due to meet up with me in person, but he still never has.”

On 23 December 2022 Frederick Diji was sentenced to eight years for conspiracy to defraud, concealing criminal property and possession of an identity document for improper means. His partner, Raquel Johnson, was sentenced to three years and nine months for money-laundering.

Afterwards, Mason stepped outside to phone Kevin Poole, who had watched the sentencing on Zoom. They spoke of their joy at the years Diji had been given, the maximum they could have hoped for, but mostly of the relief. Poole later told me he had occasionally toyed with asking for a visitor’s permit to talk to Diji in prison. To simply ask, “Why would you do this?” He admitted it was unlikely he would get an answer.

Something had struck Mason about Poole’s victim impact statement when it was read out, a mystery she had never been able to figure out. Along with others, he said that Diji had sounded Swedish on the phone. Had they just been kidding themselves? There were no recordings, but Mason’s best guess was AI.

It is surprisingly easy to create a fake accent. Fake videos, too, can be made using a few stolen images and “deepfake” technology. Profile pictures can be generated “whole cloth”, meaning reverse searches will lead to nothing or worse: the seemingly real profile of an entirely fictional person. And while the Online Safety Bill has criminalised the sharing of deepfake pornography, it has no provision for the same technology when used in fraud.

I asked Rijul Gupta, the CEO of Deep Media – a Silicon Valley company working with both US and UK governments to combat deepfakes – how accessible this tech is. “Right now, there are consumer applications that offer real-time voice-cloning and voice-transfer technology on Zoom calls, Google Meet, that are available to an intelligent consumer,” he said. How intelligent? “I would say any 15-year-old who plays Minecraft and streams it on Twitch would be able to use it.”

Gupta explained. For a full “voice-swap” – enabling the user to speak live as another person – you need nine minutes of sample audio (for instance, a young Swedish man). For “voice-conditioned vocal syntheses” – where the user types the words first, enabling voicemails – you need only three seconds. In the time it takes you to answer your phone and say, “Hello, who’s that?” a couple of times, your voice can be cloned to send to anyone, saying anything. The only thing the off-the-shelf tech can’t yet do, Gupta told me, is replicate human breathing, leaving an eerie silence between sentences.

Already, this technology is enabling “grandparent scams”, in which criminals pose as grandchildren asking for emergency funds. The rise of TikTok and Twitch means sample audio is not hard to find. In April, a Canadian woman, Ruth Card, withdrew $3,000 to help her grandson, who had called to say he needed money for bail. In June, Jennifer DeStefano, from Scottsdale, Arizona, was asked to hand over $1m in a call from her sobbing daughter, who said she’d been kidnapped. DeStefano managed to call her back, to learn she was on a skiing trip.

When we spoke again this autumn, Rebecca Mason was busy with more cases linked to Diji. Her next investigation to come to trial, she told me, was the most elaborate and sophisticated the police had ever seen. But she had found the time to stay in touch with her witnesses. One of them messages regularly, nervously checking if a man he has met online is another fraudster. Sometimes she’ll say, “I know that guy: that’s another catfish.” Other times she’ll say: “Looks OK, but please be careful.” She was planning to catch up with Poole over coffee.

Nervously, I asked about Alan Baldwin. Had he finally accepted that Fred wasn’t real? “I think he always knew,” Mason said.

There was one silver lining, she added. Now that he was no longer sending all his money to Diji, Baldwin could afford to live his life a little more: a real one. The last she had heard, he had booked his first holiday in years. Finally, there would be a new memento to place, ever so carefully, in his glass cabinet.

Sharon Turner and Kevin Poole are pseudonyms

[See also: “We’re going to disrupt”: A year inside GB News]

This article appears in the 07 Dec 2023 issue of the New Statesman, Christmas Special